Change is inevitable, and Africa is going through some very interesting changes.

Africa's population boom, demographic shifts, evolving consumer markets, and emerging economies are just a few of the megatrends that are changing the continent at a scale that has never happened before in history.

However, while change often breeds pessimism and causes people to focus on the negative news headlines about Africa, change also opens doors of opportunity for those who know where to look.

Unfortunately, by focusing on Africa's ugly problems (and not the impressive opportunities buried within them), many people could miss out on the world's last major economic and commercial frontier.

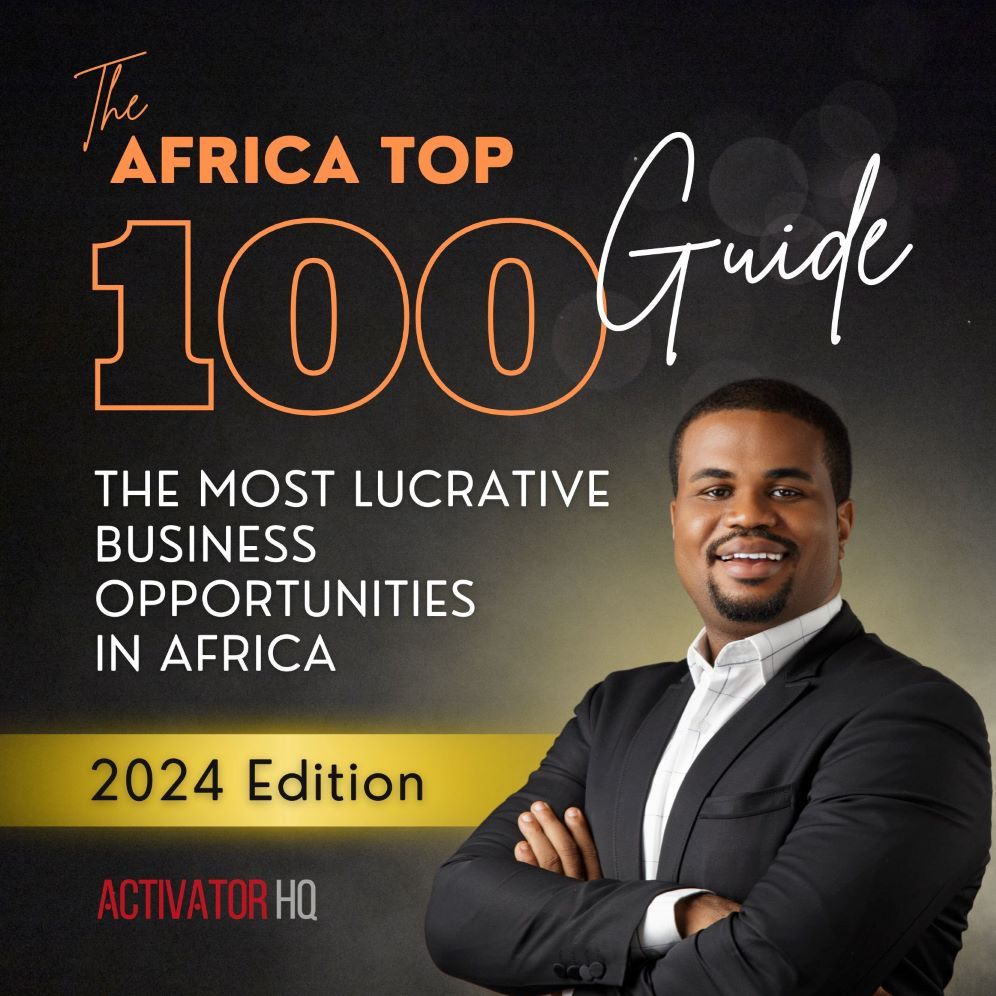

After analyzing dozens of value propositions, market gaps, demand sources, trends, and underserved niches across Africa, we have identified 100 of the most lucrative business ideas and investment opportunities the continent has to offer in 2024.

In addition to inspiring success stories and sample business plans, the Top 100 Business Ideas you’re about to explore cut across more than 30 different industries, value chains, and niches in Africa, and present a minimum total addressable market value of $100 million each.

This guide is created for entrepreneurs, innovators, investors, policymakers, project developers, and anyone who is keen to position themselves in Africa's promising and fast-changing markets in 2024.

The invaluable insights in this guide will help you discover unique and innovative ideas for your next business, product, project, investment, or income stream in 2024.

100. Waste-to-energy plants

Africa has a serious waste problem.

Currently, the continent generates more than 200 million tonnes of municipal solid waste (MSW) every year, and it’s producing more waste as the population and urban areas grow.

At 2.5% per year, Africa's population is growing at more than three times the global average, and the region now has the highest urbanization rate in the world, with its urban population projected to overtake the rural population by 2033.

As more people live in densely populated cities and towns across Africa, the explosive production of waste has become a nightmare that poses major public health and environmental challenges.

Worse still, only about half of the waste generated in Africa is collected, and more than 90% of collected waste is dumped in open landfills, canals, and rivers.

In fact, a study by UN-Habitat found that 19 of the world’s 50 biggest landfills are currently located in sub-Saharan Africa.

If Africa, a region that generates only about 10% of global municipal solid waste, already carries almost half of the world's landfill burden, waste management on the continent is expected to attract considerable global attention and investment in this decade.

One of the most exciting emerging opportunities is to recycle Africa's huge volumes of landfill waste into a valuable resource the continent desperately needs – electricity.

Waste-to-energy is a mature technology that uses a combination of incinerators, boilers, and generators, to produce electricity from municipal solid waste.

It is a proven model that has helped several European countries manage their mounting waste problems.

In just one year (2022), Europe generated 14,000 megawatts of electricity from its waste-to-energy plants. France alone has 126 waste-to-energy plants, while Germany has 121, and Italy has 40.

As of October 2023, the whole of sub-Saharan Africa had just one operational waste-to-energy plant.

With 40% of Africa’s population still without access to electricity, waste-to-energy is a promising opportunity that solves two of the continent's biggest problems in one blow.

In Ethiopia, this innovative model of recycling waste into electric power has proven itself quite well.

The $120-million Reppie Waste-to-Energy Plant in Addis Ababa (Ethiopia), which is built on the site of the capital city's biggest and oldest landfill, is an impressive example.

The plant recycles about 1,400 tons of municipal waste daily and supplies up to 30% of Addis Ababa's household electricity needs while meeting European standards on air emissions.

Another waste-to-energy plant in Ethiopia, Koshe, is to be completed in 2024 and has the capacity to generate 40 megawatts of electricity per year from 680,000 tonnes of waste.

Still, there is a lot of untapped opportunity that lies within Africa's waste problems.

Preliminary calculations by UNEP show that diverting waste away from landfills towards reuse, recycling, and recovery could, conservatively, inject an additional $8 billion every year into the African economy.

Are you interested in exploring opportunities in waste-to-energy plants, or recycling metals, plastics, glass, and organic waste in Africa?

This sample recycling business plan will interest you.

Waste-to-Energy is just one of several business opportunities we explore in our detailed guide to Africa's waste and recycling industry.

To discover more recycling opportunities in Africa, check out the full guide: Waste & Recycling in 2024: Africa's Top Business Ideas and Opportunities.

99. Diaspora investment funds

Africa has one of the largest diaspora populations in the world, with over 20 million migrants from the continent living and working in North America, Europe, and Asia.

This growing diaspora population has a massive (but largely untapped) economic advantage for Africa.

Countries like India, Israel, Mexico, and the Philippines are just a few examples that prove the investment and business potential that lies in diaspora communities.

According to Mr. Akinwumi Adesina, the President of the African Development Bank Group (AfDB), in just one decade, the value of remittances from Africans living abroad more than doubled from $37 billion in 2010 to $87 billion in 2019.

By 2021, it reached $95.6 billion; significantly higher than the total international financial aid and development assistance to Africa in the same year.

In countries like South Sudan, Gambia, Senegal, and Lesotho, inflows from the diaspora contribute at least 15% of the national GDP. In Nigeria, diaspora remittances have often exceeded crude oil revenues and foreign direct investment.

In fact, if it were a bank, the diaspora would be Africa’s third-largest bank in terms of total assets.

But this is only the beginning of a remittance wave to Africa that will get bigger in 2024 and beyond.

With a median age of 18 years, Africa's population is the youngest in the world. The continent's population is considerably younger than the populations of wealthy countries like the UK (40 years), France (42 years), Germany (45 years), Italy (46 years), Canada (40 years), Australia (39 years), Japan (48 years), and the United States (38 years).

As a result of this demographic advantage, migrants from Africa will serve as a critical labour pool and workforce for the global market for (at least) the next three decades.

It's no surprise a growing number of wealthy countries and regions are developing immigration-friendly study visas, work visas, and permanent residence programs to attract skilled people and young professionals from Africa.

And this targeted immigration strategy is working.

As a result, Africa has become, in essence, a major exporter of talent and labour to foreign markets.

In countries like Nigeria, which has Africa's biggest population, "Japa" is a very popular local term that describes the wave of emigration by doctors, nurses, bankers, engineers, and other professionals to North America, Europe, Australia, and the Middle East.

While this massive brain drain has damaging impacts on the continent's development, Africa's growing diaspora population can become a major economic force for the continent's long-term growth and development, particularly in the area of remittances and direct investment.

Currently, however, most of the remittances that flow into Africa mostly focus on family support and welfare spending.

But as more foreign investors become increasingly active in Africa and earn huge returns in emerging sectors like tech, infrastructure, and financial services, Africa's diaspora remittances can be channeled to take advantage of these investment opportunities on the continent.

The concept of a "diaspora investment fund" provides a viable alternative source for venture capital, private equity, bonds, concessional loans, mutual funds, real estate investment trusts, and other return-yielding opportunities.

Interestingly, there are signs this approach to investing Africa's remittances is taking off.

In Kenya, Pangea Trust, a startup accelerator and investment platform, raised up to $1 million from diaspora remittances for nine local startups in 2022.

Like India and Israel which have very successful diaspora bonds, some African countries like Nigeria ($300 million), Ethiopia ($4.9 million), Egypt, and Kenya have leveraged diaspora bonds to raise capital for key infrastructure projects.

Other interesting initiatives to watch include IFAD’s Diaspora Investment in Agriculture (DIA), the African Union’s African Diaspora Investment Fund, and Kenya’s African Diaspora Asset Managers (ADAM).

These exciting new platforms could shape the economic and social impacts of Africa's huge and growing diaspora remittances.

Are you thinking of starting an investment fund company that raises funds from local and diaspora investors for return-yielding opportunities in Africa?

This sample investment fund business plan will interest you:

Diaspora investment funds are just one of several business opportunities we explore in our detailed guide to Africa's financial services industry.

To discover more opportunities, check out the full guide: Financial Services in 2024: Africa's Top Business Ideas & Opportunities.

98. Specialist healthcare for medical tourists

Every year, thousands of Africans travel outside their home countries to receive medical treatment and healthcare services abroad.

This practice, widely known as “outbound medical tourism”, is a huge multi-billion dollar industry that costs Africa between $1 billion and $6 billion annually.

In fact, according to the World Travel & Tourism Council, Nigeria is the world’s third-largest source of medical tourists after the United States and Kuwait (as of 2015).

Besides countries like Tunisia that rank in the Top 25 global destinations for medical tourists, most African countries are actually “net losers” in the fast-growing global medical tourism market.

In the last two decades alone, worldwide spending on medical tourism products and services has grown by over 350%, rising from $2.4 billion in 2000 to $11 billion by 2017.

Some of the biggest winners in this market are developing countries like India, Turkey, Thailand, Malaysia, Jordan, and Costa Rica which continue to position themselves as attractive destinations for medical tourists who often cannot afford the higher medical costs in Europe and North America.

Due to rising international demand, hospitals in these destinations provide different specialties that include organ and tissue transplants, replacement surgery, cosmetic surgery, dentistry, eye care, orthopaedics, cardiovascular procedures, reproductive health, and nanotechnology services.

Interestingly, some entrepreneurs are setting up specialty medical facilities in Africa to capture the continent’s huge and growing outbound medical tourism demand.

By providing world-class and competitively-priced services that save long-distance travel time and costs, these healthcare providers offer a compelling alternative that removes the need for Africans to travel outside their country or region for medical treatment.

In Ghana, the LuccaHealth Medical Specialty Center—which has two campuses in Accra—is an interesting example of how Africa can capture domestic healthcare demand and reverse the continent’s outbound medical tourism trend.

Built at a total cost of $18 million and staffed by a combination of foreign and local medical professionals, this advanced healthcare provider offers 11 different specialties and minimally-invasive (laparoscopic) same-day surgeries, and earns a healthy 30% operating profit margin.

Major global players such as Apollo Hospitals, which is India’s biggest healthcare chain and a leading destination for medical tourists, is investing in an advanced diagnostics and cancer care centre in Dar es Salaam (Tanzania) to serve medical tourism demand in the East Africa region.

In the post-COVID era, a growing number of advanced specialist facilities that focus on Africa’s multi-billion dollar captive market are springing up across the continent.

In the not-too-distant future, countries like Ghana, South Africa, Rwanda, Tanzania, Tunisia, Morocco, and others could emerge as regional healthcare hubs and centers of excellence that may corner and dominate the market for medical tourism in Africa.

Are you thinking of starting a specialist healthcare facility that provides diagnostic and medical care services for a local and/or international target market?

This sample healthcare business plan will interest you.

Medical tourism is just one of several business opportunities we explore in our detailed guide to Africa's healthcare industry.

To discover more healthcare opportunities in Africa, check out the full guide: Healthcare in 2024: Africa's Top Business Ideas and Opportunities.

97. LPG as substitute fuel for cooking, transport, and export

In kitchens and households across the world, gas (also known as Liquefied Petroleum Gas, LPG, propane, or butane) is the cleanest, most efficient, and most widely used cooking fuel.

Besides Europe and North America which depend heavily on gas for heating, the adoption of cooking gas is also growing in developing countries.

In China, 42% of households use gas for daily cooking. In India, it's 29%. And in Indonesia, it's 17%.

However, in sub-Saharan Africa, only about 5% of households use gas for cooking.

Many people on the continent still depend on dirty fuels like kerosene, firewood, and charcoal to prepare food.

In addition to the pollution, climate change, and environmental damage they cause, these dirty fuels are responsible for toxic fumes and indoor air pollution that lead to 1.6 million premature deaths per year.

Still, despite these casualties, dirty fuels like firewood and kerosene are heavily used across Africa.

But there is a silent gas revolution that's happening in many of Africa's cities and urban areas.

At 3.9% per year, Africa now has the world's fastest rate of urbanization. The concentrated market demand in urban centers creates easier access to gas supplies and is finally unlocking the potential of cooking gas in Africa.

For a growing number of urban households, restaurants, and food processors on the continent, gas makes more economic sense than firewood, charcoal, or kerosene.

Besides the initial upfront cost of purchasing a gas stove and cylinder, the cost of using cooking gas is comparatively lower in the long run due to its superior burn efficiency, less frequent purchases, higher convenience, and lower health and environmental impacts.

In Nigeria alone, the World LPG Association estimates there is a $10 billion annual opportunity for cooking gas. On a continental level, the market potential for cooking gas is much bigger and more significant.

In addition to using gas as a cooking fuel, another interesting trend is emerging as a commercial use case for LPG in Africa.

Following frequent petrol shortages and recent hikes in petrol prices in countries like Nigeria, cost-conscious consumers are converting their cars and generators to use gas instead of petrol.

With countries like Egypt, which already has more than 260,000 vehicles that run on compressed natural gas (CNG), and cities like Johannesburg (South Africa) which operates a CNG-based public transport fleet, the recent initiative by Nigeria to acquire 3,000 CNG-powered buses is a big boost for the future of gas in Africa.

If this trend continues, the commercial and environmental benefits of using gas in the transport and power sectors will create significant domestic demand for LPG and CNG in Africa.

Besides the promising potential for gas in the local African market, the continent also has strategic advantages in the international gas export market.

With more than 800 trillion cubic feet of natural gas reserves, Africa can play a key role in the global green transition, especially with the continent’s geographical proximity to Europe and Asia — two of the world’s biggest gas-consuming regions.

Interestingly, the dramatic geopolitical changes that have happened since Russia’s invasion of Ukraine in February 2022 have thrust Africa’s gas potential into the global spotlight.

With more than 80% of Russia’s gas supplies to Europe cut off due to sanctions, many countries in the Eurozone are exploring long-term alternative sources of gas to guarantee supplies for their home markets and reduce the impacts of rising gas prices.

The loss of market share for Russia, which used to supply up to 40% of European gas demand, has created opportunities for Africa; which only met about 10% of Europe’s gas imports.

With an existing gas pipeline infrastructure between Algeria and Europe (via Italy and Spain) and a history of liquefied natural gas (LNG) exports from countries like Egypt, Nigeria, Angola, and Mozambique, there is considerable potential to supply more African gas to Europe via pipes and ships.

Already, a number of countries, including Germany, France, Italy, and Poland are negotiating deals, funding gas projects, and signing contracts for gas supplies from African exporters as part of the European Union's REPowerEU plan.

In summary, the combined local and export demand for gas in Africa will create several interesting opportunities across the value chain for entrepreneurs and businesses.

Are you interested in exploring opportunities within the local market for cooking gas in Africa?

This sample cooking gas (LPG) supplier business plan will interest you.

With applications in power generation, fertilizers, and transport industries, natural gas is just one of several business opportunities we explore in our detailed guide: Mining Business Ideas for 2024: Africa's Top Opportunities.

96. Innovative real estate investment models

Residential housing is by far the largest sector of the real estate industry and accounts for roughly 80% of the world's total real estate value.

This is why, around the world, owning your home or any kind of residential property is considered a landmark investment and a source of pride, financial security, and generational wealth.

As Africa's fast-growing population concentrates into major cities and urban areas, the market value of residential real estate has continued to rise.

Estimated at just over $12 trillion (in 2023), the value of residential real estate in Africa is projected to grow at 5.67% for most of this decade, reaching $16.7 trillion by 2028.

However, for many urban Africans who are living in the middle of this tremendous real estate boom, owning a home or investing in real estate is still a pipe dream.

Home ownership in Africa’s urban areas remains very low due to several factors that include: limited access to mortgage financing, the high upfront cost of urban real estate, and the complexities of acquiring or building your own property.

According to the African Development Bank, home ownership rates in urban Africa average between 10% and 20%. This compares poorly to the 70% average in Europe and North America. Countries like Nigeria have one of the lowest home ownership rates in the world.

Due to rapid urbanization and population growth, land and house prices are skyrocketing across Africa's major urban areas, and cities like Cape Town, Nairobi, Tangier, Luanda, Accra, and Lagos have become some of the continent's most expensive real estate markets.

Unfortunately, due to the high and rising cost of residential real estate, many people on the continent cannot afford to buy a home or invest for financial gain.

To solve this problem, a number of smart entrepreneurs are introducing innovative and affordable routes to residential real estate ownership in Africa.

The rent-to-own model is one creative approach that targets the large but untapped market of aspiring middle-class Africans who dream of owning a home, but cannot afford the upfront lump sum to pay for one without mortgage financing.

By providing the opportunity for tenants to rent homes while paying off the full cost of the property, the rent-to-own arrangement creates an innovative financing option that could positively disrupt Africa's mortgage and housing market.

In Uganda, Smart Havens Africa, a builder of climate-smart homes, has successfully deployed the rent-to-own model for its target market of single mothers and low-income households.

With over 100 residential units sold so far through this model, the company’s innovative approach to home construction and ownership has received commendation from the Royal Academy of Engineering, and has been featured on CNN, VOA Africa, and the BBC.

In Nigeria, VANK, a property technology company, offers an innovative digital platform that allows clients to buy, sell, and manage real estate properties from their smartphones.

Powered by Blockchain technology and the crowdfunding model, VANK allows anyone to buy real estate assets in groups or cooperatives, thereby opening doors for fractional ownership of real estate property in Africa.

As a result, with as little as $100, VANK's users can own a slice of a $100,000 property, thereby creating opportunities for retail and small-scale investors who cannot afford the outright purchase of real estate properties.

Figures from the Centre for Affordable Housing Finance in Africa (CAHF) show that Africa faces a shortfall of at least 51 million housing units.

The biggest housing shortages are in Nigeria (28 million units), the Democratic Republic of Congo (3.9 million), South Africa (3.7 million), and Kenya (2 million). In Egypt, more than 12 million people live in informal accommodations.

These shortages represent a significant supply-demand gap across Africa for residential real estate, providing a lucrative market opportunity for developers, investors, and entrepreneurs.

Are you interested in starting a real estate company that offers residential properties for sale and rental income?

This sample real estate developer business plan below will interest you.

Real estate financing is just one of several business opportunities we explore in our detailed guide to Africa's real estate industry.

To discover more interesting real estate business opportunities, check out the full guide: Real Estate in 2024: Africa's Top Business Ideas and Opportunities.

95. High-value cassava derivatives

Cassava is a starchy root crop that grows abundantly in sub-Saharan Africa and features in popular local staples like garri, fufu, abacha, bobolo, agbelima, and several others.

Grown in up to 40 countries on the continent, Africa is the undisputed world leader in cassava production.

The region produces 200 million tonnes or 64% of the world's annual cassava output, with Nigeria, DR Congo, Tanzania, and Ghana as the continent's top producers.

While cassava has primarily served as a staple food source for Africans, the crop presents much bigger commercial opportunities due to its versatile industrial uses.

The international trade in cassava products has been growing in recent years, with the global market value of the cassava industry, estimated at $183 billion in 2023, projected to reach $254 billion by 2032.

The four high-value cassava derivative products driving this growth in global demand are cassava starch, high-quality cassava flour (HQCF), cassava chips, and alcohol.

Cassava starch and HQCF, which have high dietary fiber and a low glycemic index, enjoy strong demand from the food and beverage industry due to their use as sweeteners, natural binding agents, texturizers, and gluten-free flour.

These cassava-based ingredients are increasingly common in functional food, snacks, ready-to-eat cereals, dietary supplements, nutritional drinks, medicines, personal care products, cosmetics, and several other applications.

Cassava chips, an energy and fiber-rich source in animal feed formulations, has proven to be a promising and cost-effective substitute for increasingly expensive feed ingredients like maize.

Studies show that cassava can substitute maize at up to 40% in cattle diets, 20 to 50% in small herbivores (goats, sheep, rabbits), up to 100% in pigs, 10 to 40% in poultry, and up to 60% in aquaculture (fish) diets.

The global market for animal feed, valued at $530 billion in 2023 and expected to double by 2033, presents a major market opportunity for cassava as commercial livestock production continues to grow around the world to feed the rising consumption of meats and other animal products.

While several types of alcohol can be processed from cassava, ethanol is the most common. The ethanol content in cassava-based alcohols can range from 10% to 40% by volume, depending on the production process.

Commonly used as a biofuel, industrial solvent, and in the production of alcoholic beverages, the global demand for ethanol reached $99 billion in 2022 and is projected to exceed $130 billion by 2030.

However, despite the huge international demand for cassava starch, HQCF, chips, and ethanol, up to 80% of cassava produced in countries like Nigeria and several African countries is consumed in its primary form as food.

Interestingly, the cassava export market is dominated by countries in south-east Asia like Thailand, Vietnam, Indonesia, and Cambodia that produce far less cassava than Africa but specialize in the processing and export of high-value cassava derivatives.

As a result, while Africa produces more than 60% of the world's cassava, it still has to import cassava-based ingredients from Asia and Latin America to support its local industrial needs in food and beverage and pharmaceuticals, among others.

Thankfully, some entrepreneurs in Africa have started transforming locally-grown cassava into high-value industrial inputs.

In 2022, Psaltry, a local company in Nigeria, partnered with Unilever to open the country’s first sorbitol production factory.

Sorbitol, an industrial sugar alcohol that can be derived from cassava, has a global annual demand that reached $1.2 billion in 2020. It is a low-calorie sweetener used in everything from toothpaste and mouthwash to pharmaceutical syrups and food products.

The new plant, which has Unilever as its largest off-taker, is expected to produce up to 24 tons of cassava-based sorbitol daily and replace up to $10 million of annual sorbitol imports into Nigeria.

Are you interested in exploring business opportunities in cassava that serve growing local or export market demand?

This sample cassava products business plan below will interest you.

94. Digital skills training & outsourcing

The world is in the digital age and the fourth industrial revolution has begun. This massive global change will have serious consequences for Africa.

According to projections, Africa’s digital economy will reach $180 billion by 2025, and $712 billion by 2050. In just four years, between 2019 and 2022, investments in the African tech startup ecosystem grew six-fold, from $492 million to $3 billion.

With the world's youngest and fastest-growing population, Africa is strongly favoured to benefit from the global digital revolution due to its demographic advantages – but only if the continent can overcome its digital skills gaps.

A report by the International Finance Corporation (IFC) estimates that 230 million jobs in Africa will require digital skills by 2030, and only a small fraction of these jobs will be in the tech sector.

Currently, African countries score between 1.8 and 5 on the Digital Skills Gap Index, far below the global average of 6. Of the world’s 20 countries with the weakest digital skills, 12 are in Africa, and only 11% of Africa’s graduates of universities and tertiary institutions have formal digital training.

In the face of these serious digital skill gaps, Africa has one of the highest (and growing) unemployment rates in the world.

It's no surprise that 87% of business leaders on the continent identify digital skills development as a priority area in need of further investment.

The Boston Consulting Group estimates that 650 million workers in Africa would need to be trained or retrained in digital skills by 2030 in order to meet the demand for digital services on the continent.

According to the IFC, the majority of demand for digital skills in Africa is expected to come from jobs outside the ICT and tech industries, and will be created by companies adopting digital technologies in manufacturing, healthcare, retail, agribusiness, education, and service industries.

The biggest digital skills gaps will cut across software development, cybersecurity, data science and analytics, digital marketing, social media management, and several other specializations.

In the cybersecurity space, for example, Africa has a shortage of over 100,000 certified professionals. As a result, up to 96% of cyber breaches go unreported or unresolved, and cause up to $3.5 billion in annual losses on the continent.

This is why digital skills training and outsourcing is a major business opportunity in Africa.

In just five countries—Nigeria, Kenya, Rwanda, Côte d'Ivoire, and Mozambique—the IFC estimates there is a digital skills training market opportunity of $11.1 billion between 2021 and 2030. This comprises training for new job seekers and reskilling of existing workers.

Already, a growing number of training startups in Africa are getting the attention (and money) of local and international investors.

Gebeya, an Ethiopian startup that trains and outsources digital talent from Africa, raised $2 million in a seed funding round in 2020.

AltSchool Africa, which provides a low-cost and diverse digital skills curriculum for participants across Africa, raised $1 million to develop its content and technology infrastructure.

Marketplaces like Andela, which has raised over $180 million from investors, have built a thriving business by matching digital talent from Africa with global companies for a fee.

There is also a growing number of initiatives and platforms such as the Digital Skills for Africa Initiative, African Coding Network, and Smart Africa Digital Academy that are attracting funding and working to provide digital skills training to young Africans.

Are you interested in starting a training and/or talent outsourcing business that serves the growing global demand for workers with digital skills?

This sample training and outsourcing business plan below will interest you.

93. Green finance for climate-friendly projects

Since the launch of the Sustainable Development Goals (SDGs) and Paris Agreement in 2015, specialized financial products that help to tackle climate change have taken root in the world's financial markets.

Green finance, also known as sustainable finance, refers to funding, financial instruments, and investments that only support environmentally sustainable projects and initiatives.

This type of finance is focused on promoting sustainable development, addressing climate change, attracting socially responsible investors, and encouraging innovation in areas such as renewable energy, energy efficiency, and sustainable agriculture.

With $1 trillion in green finance transactions in 2015 alone, the demand and market value for climate-friendly finance has exploded.

Valued at $4.2 trillion in 2022 and projected to exceed $29 trillion by 2032 (at a compound annual growth rate of 22.4%), green finance has become the fastest-growing category of the global financial services industry.

Africa, which accounts for only about 2 to 3% of global greenhouse gas emissions, is the most vulnerable continent to the impacts of climate change despite its low emissions.

According to rankings by the ND-GAIN Index, 9 out of the 10 countries most affected by climate change are African countries, with extreme weather events such as droughts and floods increasing in scale every year.

Due to its unique vulnerabilities, Africa offers a wealth of climate-related investment opportunities that range from sustainable agribusiness to renewable energy.

Businesses and projects that benefit from green finance in Africa are typically involved in renewable energy and energy efficiency, pollution prevention and control, biodiversity conservation, circular economy initiatives, and sustainable use of natural resources and land.

So far, the biggest opportunities in green finance have been in green bonds, climate finance, and carbon credits.

While there remains a huge green finance gap in Africa, the number of public and private sector success stories is growing.

Acorn Holdings, a student accommodation property developer in Kenya, raised $41 million from green bonds in 2019 to build eco-friendly lodgings for 5,000 students in Nairobi.

Several African banks have also raised funds from green bond issues. These include South Africa's Standard Bank ($200 million) and Nedbank (ZAR 1.09 billion), and Nigeria's Access Bank ($41 million).

In 2021, Gabon became the first African country to sell carbon credits on the international market. The country, whose rainforests absorb a total of 140 million tons of CO2 every year, could sell up to $2 billion in carbon credits.

As of early 2023, one tradeable carbon credit was pegged at $80-$90 per ton in Europe and $140 in the United States.

In contrast, carbon credits in Africa, which average $10 or less, present significant opportunities for the continent in the international carbon offset trading market.

With the launch of the African Carbon Markets Initiative (ACMI), Africa could produce 300 million carbon credits every year by 2030 and 1.5 billion credits annually by 2050. This could unlock $6 billion in income and support over 30 million jobs in Africa.

Green finance is just one of several lucrative business opportunities we explore in our detailed guide to Africa's financial services industry

You can learn more at Financial Services in 2024: Africa's Top Business Ideas & Opportunities.

92. Macadamia: the king of nuts

Every year, the world consumes more than 50 million tonnes of edible nuts, valued at $87.9 billion in 2023.

At the top of the list are peanuts, almonds, cashews, walnuts, and pistachios which are quite familiar to food producers and consumers around the world.

But in the last 10 years, one relatively new nut has continued to attract global attention and consumer demand.

Often considered the ‘king of nuts’ and native to Australia, macadamia nuts are one of the rarest nuts in the world.

Fun fact: They also have the hardest shell of any edible nut, requiring up to 240 kilograms of force to break.

Prized for their buttery flavour and creamy texture, macadamia nuts are rich in nutrients and plant compounds that are linked to several health benefits, including improved digestion, heart health, weight management, and blood sugar control.

As a result, macadamia nuts increasingly feature in food products, including plant-based snacks, baked goods, chocolate bars, granolas, and trail mixes.

The demand for macadamia oil is also on the rise.

Due to its high oleic and palmitoleic acid content that makes it a valuable moisturizing agent for skin and hair care, there is growing demand for macadamia oil in the formulation of body lotions, sun care products, anti-aging creams, and a growing range of natural and organic cosmetic products.

The global interest and consumption of macadamia nuts is growing fast, especially among health-conscious, organic-focused, vegan, and weight-loss consumer segments.

In the last decade alone, the global consumption of macadamia nuts increased by 80%, with high-income countries such as the United States, China, Canada, Japan, Australia, and France being the major consumers.

The international demand for macadamia nuts rose by over 300% from $370 million in 2008 to $1.14 billion in 2019. Valued at $1.75 billion in 2023, the market value of macadamia nuts is projected to continue growing at 9.3% per year, reaching $2.4 billion by 2028.

Of the three countries that currently dominate 60% of global macadamia nut production, two of them—South Africa and Kenya—are in Africa. There is also growing commercial production of macadamia nuts in Zimbabwe and Malawi.

The biggest buyers of macadamia nuts are the USA, Europe, China, and Japan which take up 28%, 20%, 12%, and 10% respectively of global exports.

The Kenya Nut Company, a family-run business, is one of the leading processors of macadamia nuts and cashew nuts in Africa.

With over 2,000 employees, seven large farms, and 8,000 acres of land under cultivation, the business sells its macadamia products in local and export markets under three brands: Out of Africa, Nutfields, and Nassu.

In 2020, the company raised $18.7 million in funding from Proparco to expand its business operations, including a $4-million investment in irrigation systems.

Macadamia is just one of several edible nuts we explore in our detailed guide to Africa's edible nuts market.

You can learn more at Crunchy Nuts in 2024: Africa's Top Business Ideas and Opportunities.

91. Aluminium and copper scrap

Aluminum and copper are the most widely used metals in the world after steel.

Due to its lightweight, durability, non-toxicity, high conductivity, and energy efficiency, aluminum is extensively used in the manufacture of aircraft, cars, consumer electronics, packaging materials, electric power lines, industrial equipment, and household appliances.

Driven by rising demand from these sectors, the global market demand for aluminum, valued at $148 billion in 2021, is expected to grow at a compound annual growth rate of 5.8% and exceed $258 billion by 2030.

Copper, prized for its malleability, high conductivity, and resistance to corrosion, has versatile uses in electrical grids, automotive systems, computers, smartphones, power cables, industrial machinery, and life-saving medical devices.

More importantly, as the world transitions to electric vehicles and renewable energy, copper is expected to play a much bigger role in these emerging technologies.

Electric vehicles, for example, use nearly four times more copper than a conventional petrol or diesel car.

The international high demand pressures for copper are already leading to shortages and supply chain challenges in major copper-producing regions like South America.

Considered a barometer for the health of the global economy, the price of copper has risen by almost 500% in the last two decades, from $0.74/pound in 2003 to over $3.85 in late 2023.

But how does Africa fit into the growing global opportunity that aluminum and copper present?

While Africa has sizeable reserves of aluminium and copper ores in countries like Zambia, Congo DRC, Guinea, Ghana, South Africa, Uganda, and Mozambique, recycling aluminum and copper scrap is largely preferred to mining raw ores.

Because aluminum and copper can be recycled infinitely without any loss of quality, recycling provides huge energy, cost, and environmental advantages in comparison to mining virgin ores from the earth.

Take aluminum, for example. Only about 5% of the energy needed to mine and smelt aluminum ore is needed to recycle scrap aluminum.

As a result, recycled aluminum and copper are much cheaper and cause less environmental pollution than mining and processing raw ores.

Due to the high demand for recycling, the global market for aluminum scrap is expected to grow by five times its current size and surpass $25 billion by 2030. The current value of the copper scrap market has already crossed $65 billion.

This is why the value of scrap metals like aluminum and copper is rising in many African countries.

Aluminum and copper scrap are mostly recovered from end-of-life vehicles and aircraft, demolished buildings, discarded home and office appliances, as well as scrap machinery and equipment.

Some innovative startups in Africa, like Romco Metals, are already milking the lucrative opportunities in scrap metals.

The fast-growing company, which operates in Nigeria and Ghana, specializes in collecting and recycling scrap aluminium and copper for local sale and export.

With more than 3,000 tonnes of recycled scrap per month and quarterly revenues of $20 million, the company raised $6.2 million from investors in 2022 and is valued at over $180 million.

As of March 2023, the international market price of scrap aluminum ranged between $800-$1,500 per ton, while copper scrap stood at $2,750-$4,500 per ton, depending on the quality, quantity, and other variables.

Are you interested in exploring opportunities to recycle scrap metals into reusable raw materials for industrial users in the local and export markets?

This sample recycling business plan will interest you.

Scrap metal recycling is just one of several business opportunities we explore in our detailed guide to Africa's waste and recycling industry.

To discover more recycling opportunities in Africa, check out the full guide: Waste & Recycling in 2024: Africa's Top Business Ideas and Opportunities.

90. Specialty African spice mixes

Humans and spices have a very long history.

For centuries, spices were valued as expensive commodities that shaped global commerce and trade routes and influenced geopolitics, economy, cultural exchanges, and regional cuisines.

Today, spices remain a multi-billion-dollar global industry. Valued at $18.47 billion (in 2022), the worldwide trade in spices and seasonings is projected to exceed $25 billion by 2030.

However, while the spice trade has been historically dominated by popular individual spices like peppers, ginger, cinnamon, vanilla, and saffron, there is an emerging trend of consumer preferences for spice mixes.

Spice mixes are a blend of different spices that are prepared in specific proportions and can be branded for use in particular recipes or cuisines.

In addition to the convenience they provide to consumers, spice mixes allow anyone to easily explore new tastes and cuisines, and experiment with exotic recipes.

Spice mixes like ‘masalas’, for example, are largely responsible for the mainstream adoption and popularity of Indian recipes like chicken tikka masala, chicken curry, and masala chai in Western cuisine.

Surveys show that consumers in developed countries are craving new and authentic ethnic foods and up to 32% of those surveyed are willing to pay extra for them.

The adoption of ethnic foods is rising across the world, driven by migration, social media, and the growing tendency among young people to experiment, eat out, and try dishes from other cultures.

Valued at $76 billion in 2022, market analysts project the global ethnic food market could nearly double by the end of the decade, reaching $131 billion by 2030.

However, while ethnic flavours like Indian, Chinese, Thai, Vietnamese, and Mexican have successfully penetrated the global mainstream, African flavours largely remain on the fringes.

African cuisine, known for its rich and complex flavours that are infused with a wide variety of spices, is largely unexplored by the rest of the world.

Interestingly, Africa has a number of high-profile specialty spice mixes that have huge export potential and could unlock a greater global curiosity for the continent's dishes, recipes, and cuisine.

Ethiopian spice mixes like berbere and mitmita are becoming popular in North America and Europe where they are relished for their spiciness and flavour depth in barbecues and meat dishes.

Ras el hanout, marketed as one of the world's finest and most exotic spice blends, is a famous spice mix from Morocco that consists of 40 to 100 different local spices.

The Yaji or Suya spice blend, popular in West African grilled meat, is gradually penetrating Western barbecue culture and has been featured in recipes by McCormick & Company, the world's largest maker of spice and seasoning products.

Harissa is a popular spice mix that is native to the Maghreb region of North Africa. Tunisia is the world's biggest exporter of prepared harissa and in 2022, UNESCO listed the spice blend as part of Tunisia's Intangible Cultural Heritage.

From Egypt’s Duqqa and Za’atar, to Mozambique’s Peri Peri, and West Africa’s Jollof Rice and Pepper Soup spice mixes, Africa has a lot of untapped potential with locally popular spice mixes that can enter the global mainstream.

Interestingly, some African entrepreneurs and businesses are making a global mark in the spice industry.

Iya Foods, founded by Nigerian-born entrepreneur Toyin Kolawole, is an African-inspired food company based in Illinois, Chicago. The company's range of African sauces, seasonings, and spice mixes include Piri Piri, Jollof Rice and Pepper Soup, and Fried Rice spice blends.

Kolawole, who grew the business by pitching to potential buyers at trade shows in the USA, has landed several successful partnerships, and her company’s products are now stocked by the likes of Walmart, Amazon, and other retailers in the US.

In 2019, Dieudonné ‘Diego’ Twahirwa, a Rwandan entrepreneur and CEO of Gashora Farms, landed a $500 million deal to supply 50,000 tonnes of dried chilli pepper to China over a five-year period.

Agricorp International, a startup that specializes in the processing and export of ginger from Nigeria, raised $17.5 million from investors in 2021 to support its expansion.

Specialty African spice mixes are just one of several opportunities we explore in our detailed guide to Africa's spices and seasonings market.

You can learn more at Spices and Seasonings in 2024: Africa's Top Business Ideas and Opportunities.

89. Elder care and assisted living services

With a median age of 19 years, Africa has a population of predominantly young people.

However, about 3% of the continent's population, or over 60 million people, are in the retirement bracket, aged 65 years and above. In countries like South Africa, Seychelles, and Mauritius, the proportion of the elderly population averages 6 to 12%.

Sadly, the aging experience is getting harder (and more frustrating) for senior citizens in Africa.

In many cultures across Africa, families and relatives tend to take care of aging adults. Unfortunately, largely due to rapid urbanization on the continent, more elderly people are living out the rest of their lives alone in cities and urban areas.

Unlike the communal lifestyle in rural settings, the nature and demands of urban life tend to weaken traditional family support systems and stretch informal safety nets for the elderly.

As a result, with more working-age Africans migrating out of their home countries in search of economic opportunities, there is a growing market need to develop formal long-term care systems that enable aging parents and older people to receive adequate care and live the rest of their lives with dignity.

The World Health Organization (WHO) projects the population of elderly people in sub-Saharan Africa will reach 67 million by 2025 and 163 million by 2050.

In the absence of close family members, elderly people in urban areas will need care and living assistance to deal with issues like loneliness, chronic or age-related medical conditions, memory disorders, or simply need help with mobility, incontinence, or other challenges.

This is a big and worsening problem the youth-focused demographic narrative of Africa doesn’t give enough attention to.

In countries like Ghana, for example, the World Health Organization estimates that more than half of people aged between 65 and 75 require some help with daily activities.

With 64.5% of Africa's population living with chronic diseases like diabetes, hypertension, cancer, depression, arthritis, and heart disease, elderly people are particularly vulnerable to disease and fatal accidents.

According to the WHO, of the estimated 424,000 people who die from falls every year, 80% are in low- and middle-income regions like Africa, and adults older than 65 years suffer the greatest number of fatal falls.

Africa now has an emerging market for retirement homes, assisted living facilities, live-in caregiving services, senior care products, and a range of solutions targeted at the urban elderly and those who love them but are unable to physically care for them.

Interestingly, retirement homes and long-term care are a huge global industry, and Africa is missing out on this lucrative and fast-growing market.

Valued at $1.05 trillion in 2022, the global demand for long-term care is projected to double in a decade and exceed $2 trillion by 2032, at a compound annual growth rate of 7.2%.

The United Nations estimates the global population of people aged 65 and over is growing faster than any other age group. At the same time, there is a critical shortage of caregivers, especially for elderly people who want to continue living at home.

Unfortunately, in sub-Saharan Africa, only a few countries like South Africa, Seychelles, and Mauritius have developed market ecosystems and lucrative business models that actively serve senior citizens.

Mauritius, which has positioned itself as an attractive international destination for retirees and the elderly, offers a special retirement visa and residence program, a zero-tax system for retirees, and a range of hospitality and healthcare services focused on the elderly.

As a result, the country continues to successfully attract senior citizens and high-net-worth retirees from regions outside Africa, especially from Europe and North America.

In South Africa, companies like Auria Senior Living develop and manage sophisticated retirement communities that provide assisted living services that include everything from home-based care to supportive care (frail care) and dedicated dementia care.

Fortunately, in other parts of sub-Saharan Africa, a growing number of startups are focusing on the long-term care market for the elderly.

In Nigeria, which is likely home to Africa’s largest population of people aged over 65, startups like GeroCare and Greymate Care are leveraging digital technology to expand access to long-term care for aged people in urban areas.

GeroCare is a subscription-based service that focuses on preventive healthcare and enables access to regular doctor home visits, telemedicine, and medical reports.

The company was a Top 20 Finalist at the 2021 Africa Business Heroes Prize and a recipient of the Google Black Founders Fund.

Greymate Care solves the problem of hiring untrained, unvetted, and inexperienced caregivers who often mistreat vulnerable individuals and provide poor-quality care.

In addition to biometric verification and adequate training for caregivers, Greymate Care provides comprehensive remuneration packages that incentivize diligent and long-term caring, rather than the prevalent ad-hoc hiring approach.

In 2024, we anticipate more new and interesting startups will enter this growing market, and existing players will continue their efforts to scale, enhance offerings and value propositions, and improve their competitive advantages.

88. Afrobeats: the business of African music

In February 2021, Spotify, one of the world's biggest digital music streaming platforms (that raked in over $11 billion in revenues in 2022), shocked market analysts when it announced its expansion into 40 countries in sub-Saharan Africa.

With music streaming revenues in Africa projected to triple from $92 million in 2021 to $315 million by 2026, global music streaming giants like Spotify, Apple Music, Boomplay, YouTube Music, and Audiomack are taking key positions in the African market to explore a strategic growth opportunity.

All of this is happening in light of the meteoric rise of Afrobeats, an emerging music genre from Africa that is making a strong mark on pop culture and global music.

Sparked by a continuous wave of catchy tunes, prolific music talent, and the wild virality of Afrobeats-inspired dances, memes, and videos on TikTok, Instagram, and YouTube, the genre is finally crossing over into the global mainstream and has become Africa's biggest cultural export.

Afrobeats music now features frequently in billboard charts in Europe and North America, and a growing number of artistes from the genre continue to win international awards (including The Grammy's) and sell out live shows and tours to massive audiences within and outside the African continent.

Several international A-list music stars, including Beyoncé, Drake, Chris Brown, Ed Sheeran, and Justin Bieber have sampled Afrobeats music and continue to collaborate with artistes from the genre to release songs.

Interestingly, three of the world's biggest music labels—Sony, Universal, and Warner—are increasingly signing Afrobeats artistes, closing licensing deals, and expanding their footprint in Africa.

These partnerships, combined with the virality factor of social media and the spread of music streaming platforms, have greatly helped to introduce Afrobeats to new audiences around the world and global demand for songs from the genre continues to grow in leaps and bounds.

Since Reggae (from Jamaica) started its domination of global music in the 1970s, no other genre of "African" origin appears to have reached that peak until Afrobeats. In essence, we are likely now in the middle of another African-led global music revolution.

And 2024 may just be the year that Afrobeats starts to transcend music and pop culture and establishes itself as a formidable international business and branding force.

In addition to the multi-million-dollar opportunities to earn from music streaming, downloads, licensing, royalties, and ad revenues, Afrobeats also has a unique opportunity to leverage international brand deals and sponsorships.

Thankfully, there is a proven playbook that Afrobeats can learn from.

Hip-hop music, created and popularized by African-American artistes, has built a multi-billion-dollar ecosystem of consumer brands that leverage the power of music to build brand value and sell products to millions of people.

In addition to lucrative endorsements and brand deals with the likes of Adidas, Hennessy, Versace, Nike, Coca-Cola, Ralph Lauren, and several others, hip-hop artists have also used their cultural influence to launch several successful businesses and iconic proprietary brands.

Examples of remarkable successes include Dr. Dre's Beats headphone brand (which was sold to Apple for over $3 billion), Diddy's Ciroc Vodka and Sean John fashion, and Jay Z's Rocawear, among others.

Africa, with its emerging economies and the world's youngest population, is an attractive growth market for multinational consumer brands and presents a unique home advantage for Afrobeats to repeat the hip-hop playbook.

If the industry pulls this off, our estimates suggest that Afrobeats could potentially earn more than $2 billion for the African continent in brand deals and proprietary products alone over the next 10 years.

Music (Afrobeats) is just one of several lucrative business opportunities profiled in our detailed guide to Africa's media and entertainment market.

You can learn more at Media & Entertainment Business Ideas for 2024: Africa's top opportunities.

87. Electric vehicle charging stations

It is now more likely than ever that the shift to electric vehicles (EVs) will happen in our lifetime.

The United States, the European Union, and other major world economies are making significant commitments to pivot to EVs. There is also growing competition among new and established car companies – like Tesla, Ford, Toyota, Volkswagen, etc. – to lead the global market transition to EVs.

In 2021, sales of electric cars reached 6.6 million units, growing its market share by more than 300% from just two years earlier.

As demand for EVs accelerates in the world’s developed markets, analysts estimate that up to 54% of new cars sold by 2035 could be electric vehicles.

Better still, the average price of an electric vehicle (which used to be expensive and unaffordable for most consumers) continues to drop each year.

In 2023 alone, the price of new EVs sank by up to 42% while the price of used electric vehicles had a 19% year-on-year drop.

With more traditional carmakers like Ford, Hyundai, GM, BMW, and others entering the market with EV models to challenge dominant players like Tesla, the average price of electric vehicles is gradually trending into the affordability range.

Also, the rise of Chinese EV brands like BYD, Wuling, Nio, Xpeng, and Zeekr is heating up competition in the global electric car industry and helping to drive down prices.

But what will this emerging global opportunity in electric vehicles mean for Africa?

It appears the African market presents serious but exciting challenges that uniquely position the continent to exploit the benefits of electric vehicles.

For decades, many African countries have struggled with long queues at fuel stations, crippling fuel shortages, and frequent hikes in the price of fuels that are critical to the transportation and energy needs of consumers.

In 2023 alone, the retail price of petrol and diesel rose dramatically in a number of African countries, including Nigeria, Uganda, Kenya, and Tanzania. In Nigeria, the petrol price hike exceeded 200% as the government removed controversial subsidies.

Still, with rising oil prices in the international market and the unfavourable impacts of the ongoing Russia-Ukraine conflict, the IMF estimates that Africa's fuel import bill will grow by about $19 billion.

Faced with frequent fuel shortages and high costs of petrol and diesel, electric vehicles present a very strong value proposition to African consumers.

However, besides the lucrative opportunities for importing, producing, and selling EVs in Africa, there is a much bigger business opportunity in providing the key infrastructure – mainly charging stations – that will support the use of electric vehicles on the continent.

If anything, the key reason why electric vehicles have not yet taken off in Africa is largely due to the lack of, and limited access to, support infrastructure – especially charging infrastructure.

As a result, those early movers who take advantage of this infrastructure gap in the African market could reap huge benefits.

Already, there is a small but growing market activity of companies that are installing and managing electric charging station infrastructure.

In South Africa, GridCars has closed a $1.87 million deal with carmaker Jaguar and another contract with Audi to install over 150 charging stations in the country’s major cities.

In Kenya, Ampersand is partnering with oil marketer, Total Energies, to set up battery charge swap stations in over 140 solar-powered locations across the country.

In Morocco, Afrimobility is planning to install a large 700 km-long network of fast-charging stations to serve electric vehicle owners.

Before the end of this decade, more charging stations could emerge in other parts of the continent as the cost and appeal of EVs penetrate deeper into the African market.

86. Rare earth elements

Mining opportunities in Africa mostly focus on crude oil, natural gas, precious metals, and gemstones.

But many people don't know about Africa's huge but untapped opportunity in rare earths.

Rare earth elements (REE), also known as lanthanides, are a group of 17 important minerals that have strategic applications in several industries, particularly technology, due to their useful conductive, magnetic, and electronic properties.

In fact, many of today’s technologies would not be possible without rare earth elements.

Cerium, which is the most naturally abundant rare earth element, has a wide range of industrial and biological applications. It is a vital ingredient in the manufacture of glass and several metallic alloys, and is widely used in petroleum refining, automobile catalytic converters, and carbon-arc lighting in the movie industry.

Neodymium and praseodymium are the rare earths used in the production of rechargeable batteries for electric vehicles (EVs).

With more than 16 million EVs in the world today and the share of new passenger EVs growing at an average rate of 50% per year, the rising demand for batteries will put significant pressure on the production of neodymium and praseodymium.

Yttrium, terbium, and europium are used in televisions and display screens for smartphones and computers. Gadolinium is required to produce X-ray machines and MRI scanning systems.

In electronics and semiconductors, the most widely used rare earths are lanthanum, cerium, neodymium, samarium, europium, terbium, and dysprosium.

In addition to the above uses, one of the biggest drivers of demand for rare earth elements is magnets, which are used in disk drives, and electric motors in vehicles, wind turbines, and other products.

Magnets actually represent up to 20% of the world’s consumption of rare earths.

According to Research and Markets, the global market demand for rare earths, valued at over $7 billion in 2021, is expected to double this decade and surpass $15 billion by 2030, growing at a compound annual growth rate of 9.1%.

As more advanced technologies like artificial intelligence and 5G emerge, the international demand and significance of rare earth elements will continue to grow considerably.

Due to its strategic industrial importance, reliable access to rare earth elements provides a strong competitive and technological advantage. This explains why the world’s top economies are scrambling to secure supply chains for rare earth.

Currently, China dominates the global market for rare earths. It is by far the world’s largest producer, importer, and consumer of rare earth elements, and processes up to 80% of the world's rare earth supplies.

However, as geopolitical and trade tensions rise between China, the United States, and its allies, there is a growing push to seek alternative sources of rare earths and diversify away from the global dependence on China.

The United States is already stockpiling rare earths to support its defence technologies critical for national security. It has ramped up investments in processing facilities to secure its domestic rare earth supply chain.

In its efforts to develop alternative supply chains, the European Union has created initiatives like the Secure European Critical Rare Earth Elements (SecREEts) to ensure a reliable and uninterrupted supply of rare earth elements and reduce the EU’s reliance on foreign competing economies.

Also, Japan has extended its stockpile of critical materials to reduce its dependence on China for rare earths.

As the world’s biggest economies actively jostle for alternatives to guarantee future supplies of rare earth elements, Africa presents a key market opportunity in the fast-growing global market for rare earths.

The African continent has a number of significant rare earth deposits in eastern and southern Africa, and several rare earth mining projects are currently at different stages of development.

The Gakara Rare Earth Project in Burundi is one of the world’s highest-grade rare earth deposits and the only producing rare earth mine in Africa.

In South Africa, the Glenover, Phalaborwa, and Zandkopsdrift rare earth projects are on the radar of international players.

Based on preliminary economic assessments, the Phalaborwa project is expected to yield a 75% operating profit margin and a payback period of only two years.

In 2024 and beyond, there will be several other important rare earth projects to watch in Africa.

They include the Makuutu Project in Uganda, the Ngualla Rare Earth Project in Tanzania, Tantalus in Madagascar, Xiluvo REE Project in Mozambique, Lofdal Heavy Rare Earths Project in Namibia, Kangankunde in Malawi, and the Longonjo Project in Angola.

Are you interested in exploring opportunities in mining valuable minerals in Africa that serve a fast-growing global demand?

This sample mining business plan will interest you.

Rare earth mining is just one of several business opportunities we explore in our detailed guide to Africa's mining industry.

To discover more recycling opportunities in Africa, check out the full guide: Mining in 2024: Africa's Top Business Ideas and Opportunities.

85. Solar-powered cold storage

Every year, up to a third of food produced globally is lost or wasted, causing up to $1 trillion in annual economic losses.

The Food and Agriculture Organisation (FAO) estimates about 40% of food produced in sub-Saharan Africa is wasted each year, amounting to 170 million tonnes. Wasting food at this scale is unconscionable in a continent that struggles with food security.

In Nigeria alone, the agricultural sector loses up to $268 billion in post-harvest losses every year, according to a March 2022 report by USAID.

The most affected foods are fresh and highly perishable products such as dairy, fish, seafood, fruits, and vegetables.

In addition to limited food supplies, higher food prices, and reduced economic returns for farmers, food waste in Africa leads to losses of critical resources such as water, fertilizers, energy, and land used in the production of agricultural produce.

While significant attention is given to the need to increase food production in Africa to feed its fast-growing population (projected to double its current size by 2050), far less attention is given to reducing food loss and waste.

With so much food already going to waste, producing more food may not be an effective solution to fighting hunger and food insecurity in Africa.

This is why creating innovative and practical solutions to the continent’s food waste problem presents a major lucrative opportunity.

The World Bank estimates that just a 1% reduction in post-harvest losses could save $40 million each year in sub-Saharan Africa.

Cold storage, the practice of preserving perishable food items in a temperature-controlled environment, is emerging as a promising solution for Africa.

The ability to refrigerate or freeze farm produce at optimal temperatures can improve the availability and quality of food, help stabilize food prices, boost incomes for local farmers and food sellers, ensure long-term food security for the continent, and unlock Africa’s competitive potential as a major food exporter.

Unfortunately, most cold storage solutions that currently exist are neither practical nor affordable for Africa’s smallholder farmers and small businesses who supply the bulk of the continent’s food.

Many cold storage facilities require grid electricity which is often expensive and unreliable. Also, high fuel costs limit the use of diesel- and petrol-powered generators.

This is why solar-powered cold storage solutions hold the key to unlocking Africa’s capacity as a food production powerhouse.

With abundant year-round sunshine in many parts of the continent, solar-powered cold storage systems provide a cheap, clean, modular, and decentralized energy source for preserving millions of tons of food across the continent.

Interestingly, a growing number of innovative startups in Africa are focused on solving the food waste problem by penetrating the market with solar-powered cold storage solutions.

Koolboks, which operates in Nigeria, provides solar-powered cooling units under lease-to-own and pay-as-you-go models to business owners in off-grid locations.

The company received $500,000 from the Shell-funded impact investment fund, All On, and raised up to $3.5 million from investors.

InspiraFarms provides small-scale solar-powered cold storage facilities for horticultural farmers in Africa. Its clients include Kakuzi Plc, the largest producer of avocados in East Africa, and Lauetta Farm, a major producer and exporter of blueberries in Zimbabwe.

To expand its services, the company successfully closed a €3.1 million Series B funding round, which also unlocked a €1.2 million grant from the Shell Foundation.

ColdHubs is an innovative “plug and play” solar-powered walk-in cold room solution that is installed in farms and open-air markets in parts of Nigeria.

Based on a pay-as-you-store subscription model, the modular facility effectively extends the freshness of fruits, vegetables and other perishable foods from 2 days up to 21 days.

In 2021, the company received a $500,000 grant from Heifer International’s AYuTe Africa Challenge to support its solar-powered pop-up cooling stations.

Are you interested in starting a business that develops solar energy solutions to power Africa's clean energy transition and meet niche needs like cold storage?

This sample solar developer business plan will interest you.

Solar energy solutions like cold storage are just one of several business opportunities we explore in our detailed guide to Africa's energy and utilities industry.

To discover more recycling opportunities in Africa, check out the full guide: Energy & Utilities in 2024: Africa's Top Business Ideas and Opportunities.

84. Organic fertilizers

In the last 30 years, the amount of food produced per person in Africa has fallen. As a result, the continent is not producing enough food to keep pace with its fast-growing population.

One key reason agricultural yields in Africa are so low is soil infertility.

The International Fund for Agricultural Development (IFAD) estimates that Africa loses the equivalent of over $4 billion worth of soil nutrients each year, largely due to overcropping and wind and water erosion.

To adequately replenish the nutrient quality of its soils and boost food production, Africa needs to significantly increase fertilizer use.

No region in the world has been able to boost agricultural production without increasing fertilizer input. Increased use of fertilizer was a key pillar of the Green Revolution that boosted crop yields in Asia and Latin America in the 1960s and 1970s.

Currently, farmers in both regions use an annual average of 140 kilograms of fertilizer per hectare of crops. The global average is about 80 kilos.

However, across sub-Saharan Africa, farmers only use an average of 8 kilograms of fertilizer per hectare per year – less than 10% of the global average and significantly below the 86kg/ha recommended by the UN's Food & Agriculture Organization (FAO).

Unfortunately, one of the biggest hurdles to improving fertilizer use in Africa is the cost (and availability) of fertilizers.

With fertilizers taking up to 40% of a farm's operating expenses, the cost of fertilizer is a major consideration for farmers who wish to make a profit.

Worse still, about 90% of fertilizers used in sub-Saharan Africa are imported, making the continent highly vulnerable to shocks in the international market.

In the last two years alone, the cost of mineral (inorganic) fertilizers has doubled due to a combination of factors that include rising input costs, supply restrictions as a result of the Russia-Ukraine conflict, and export limits on fertilizers by China.

Local logistics of imported fertilizer is also a major challenge.

IFAD estimates that transporting fertilizers from an African seaport to a farm located 100 kilometers inland can cost more than shipping the same fertilizers from North America to the African seaport. As a result, farmers in Africa often pay two to four times the average world price for fertilizer.

In addition to its high and rising financial cost, mineral or synthetic fertilizers--which are the dominant type of fertilizer used in many parts of Africa—significantly contribute to environmental problems such as water pollution and greenhouse gas emissions.

Thankfully, organic fertilizers, which are derived from animal or plant-based sources such as manure or compost, are an eco-friendly and cost-effective alternative to synthetic fertilizers.

Unlike synthetic and chemical-based fertilizers which are mostly import-dependent, more expensive, and harmful to the environment, organic fertilizers are made from natural, low-cost, and locally available waste materials that can be recycled back into nature.

Studies have found that some types of compost have greater nutrient value than mineral fertilizers. They release nutrients slowly, improve soil health, have a high biodegradability, and boost crop performance.

As global efforts to mitigate the effects of climate change gain momentum, international demand for organic fertilizers is on the rise.

Valued at $11.94 billion in 2023, the global market demand for organic fertilizers is projected to reach $15.9 billion by 2028, growing at a compound annual growth rate of 5.9% during the forecast period (2023-2028).

While Africa currently has the world’s lowest organic fertilizer use rate, the continent presents a compelling growth market opportunity for organic fertilizers.

Some entrepreneurs and businesses on the African continent are already serving the fast-growing niche market for organic fertilizers.

In Kenya, Agri Flora produces granulated and liquid fertilizers from organic waste materials. The company’s slow-release fertilizer, which is applied on wheat and maize farms, can give up to 40-60% more yield than synthetic fertilizers.

In Uganda, Marula Proteen converts organic waste from markets in Kampala city into high-quality protein for animal feed and nutrient-rich compost that substitutes expensive mineral fertilizers.

83. Poultry feed production

Africa is home to 2.15 billion chickens. That's almost double the continent's human population.

Feeding these chickens to adequately meet Africa's fast-growing demand for eggs and meat has become a multi-billion-dollar business opportunity.

In the last two decades alone, meat consumption has been shifting towards poultry, outpacing conventional meats like beef and pork.

In fact, since 1999, the global consumption of chicken has doubled. That’s more than three times the growth rate of pork and 10 times the consumption growth rate of beef.

In Africa, chicken production in Africa increased by almost 2 million tonnes between 2000 and 2013, and the continent’s output is projected to reach 11 million tonnes by 2030.

According to the FAO, global poultry meat consumption is projected to reach 154 million tons by 2030, representing 41% of protein from meat sources. The global shares of beef (20%), pork (34%), and sheep/goat (5%) are expected to be much lower than poultry.

Largely due to genetic innovations, today's chicken breeds convert feed into protein faster than any other farm animal, including cattle, pigs, sheep, and goats.

As a result, in many parts of Africa, an egg is one of the single cheapest units of raw animal protein you can buy in the market.

As expected, Africa's growing demand for chicken meat and eggs has had a huge effect on the demand for poultry feed.

Quality and nutritionally balanced poultry feed, which can account for up to 60 to 70% of the operational costs of raising layer or broiler chickens, is a major cost burden and a critical success factor for poultry farms.

Market projections show the demand for poultry feed, valued at $119.8 billion in 2021, could reach $217 billion by the end of the decade.

In addition to grains, oilseeds, fishmeal, and other ingredients required to produce poultry feed at a commercial scale, there is a wide range of additives, premixes, and supplements that are used to boost the quality and nutritional value of poultry feed.

However, due to reliance on imports, the rising cost of poultry feeds has created opportunities for valuable and cost-effective local substitutes.

Fishmeal, a key source of protein in poultry feed that is made from wild-caught small marine fish, is an interesting example.

Currently, up to one-quarter of fish caught in seas and oceans are used to make protein-based fishmeal.

However, due to the combined effects of high global demand and dwindling fish stocks in the world’s oceans, fishmeal has become an expensive luxury ingredient in poultry diets. In the last 20 years, the price of fishmeal has increased 5-fold to a present-day cost of around $1,850 per tonne.

As a result, there is growing pressure to find local, sustainable, and alternative protein sources that can substitute fishmeal in poultry feed.

One of the most promising opportunities is to recycle organic waste into protein by breeding black soldier fly (BSF) larva, an insect that can consume twice its weight in organic waste in a single day, and can grow its weight by up to 10,000 times over a 14-day period.

BSF larva contains up to 45% crude protein and is high in key nutrients. This makes BSF larva a suitable substitute for fishmeal in animal feed formulations for poultry, and also for fish, pigs, and other livestock.

With global demand for fishmeal growing at an annual rate of 8.3% and estimated to exceed $10.3 billion by 2030, there is a significant market opportunity for entrepreneurs and businesses in the emerging value chain for breeding, processing, and marketing BSF larva-based protein for poultry feed.

In recent years, creative entrepreneurs in Africa have joined the fray to develop this interesting alternative to fishmeal.

Inseco, an innovative startup in South Africa, specializes in converting low-value organic by-products into nutritious and sustainable insect protein ingredients for animal feed.